Schedule

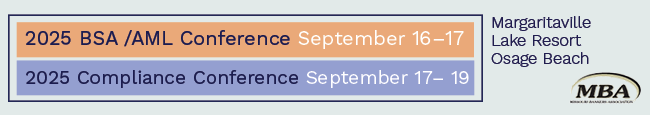

The Compliance Conference begins at 2:30 p.m. Wednesday, Sept. 17, and concludes at 11:45 a.m. Friday, Sept. 19.

Wednesday, Sept. 17

| 2:30 p.m. |

Registration

|

| |

|

| 3:30 p.m. |

What’s New in Credit Reporting and Credit Scores?

Kevin Thompson, Relationship Manager | Confluent Strategies

As new credit scores come online, how do you determine what score is best for your bank? This session breaks down how the new credit score models affect lending and the impact of alternative data on credit scores as you learn how to evaluate score performance head-to-head on your portfolio. Dive into the differences between hard credit versus soft credit inquiries, as well as the best options for customers concerning a credit lock versus a credit freeze. |

| |

|

| 4:30-5:30 p.m. |

Exhibit Showcase & Opening Night Reception

|

| |

|

Thursday, Sept. 18

| 7:45 a.m. |

Registration & Exhibit Showcase Open

|

| |

|

| 7:30 a.m. |

Breakfast

|

| |

|

| 8:15 a.m. |

Call to Order

|

| |

|

| 8:30 a.m. |

Community Reinvestment Act Refresher

Patti Joyner, CRCM, Founder | Financial Solutions

With so much focus on CRA modernization, attention also should be given to refreshing your core knowledge of the existing CRA key concepts and requirements. This session will review assessment area delineation principles, public file requirements and notices, community development activities and qualification for CRA consideration, as well as the impact of the bank’s performance context.

|

| |

|

| 9:30 a.m. |

Refreshment Break

|

| |

|

| 9:45 a.m. |

The Role of AI in Risk Management and Banking: Innovations, Challenges and Future Trends

Angela Murphy, Ph.D., Vice President of Marketing and Solutions | Pidgin

Delve into the transformative impact of artificial intelligence on the financial services industry, particularly in areas like risk management, fraud prevention and regulatory compliance. Gain insights into the ethical considerations, regulatory challenges and future trends shaping AI adoption in banking.

|

| |

|

| 11 a.m. |

Refreshment Break

|

| |

|

| 11:15 a.m. |

Missouri Division of Finance Update

Joe Crider, Supervisor of Consumer Credit | Missouri Division of Finance

Learn about “hot buttons” in exams and common violations while discussing potential rule changes, recent or upcoming changes to state laws and regulations and exam coordination with federal agencies.

|

| |

|

| 12:15 p.m. |

Luncheon

Exhibitor Prize Drawings |

| |

|

| 1:15 p.m. |

Reg E Disputes and Debit Card Fraud

Shaun Harms, CRCM Principal/Consulting, Regulatory Compliance | Forvis Mazars

Activity is on the rise for Reg E disputes and credit card fraud. With social media and other platforms helping customers turn in “disputes,” it is important to know what a dispute is under Regulation E. Know the procedures to limit the bank’s liability and still stay within the requirements. |

| |

|

| 2:30 p.m. |

Refreshment Break

|

| |

|

| 2:45 p.m. |

Avoiding Change Management Whiplash

Patti Joyner, CRCM, Founder | Financial Solutions

This session will focus on the knowledge and skills required to successfully navigate organizational change effectively, minimizing disruption and maximizing success. Deepen your understanding of how to identify the changes, implement effective strategies to manage resistance and foster communication and engagement throughout the transition. |

| |

|

| 4-5 p.m. |

Peer Group Sessions

Breakout Sessions by Asset Size

Gather with your peers to compare notes on issues facing your bank.

|

| |

|

Friday, Sept. 19

| 7:15 a.m. |

Breakfast

|

| |

|

| 8 a.m. |

Comprehensive De-Escalation

Tim Keck, Senior Consultant | SafeHaven Security Group

As stress increases across our society, anger and conflict have increased as well. For many, physical violence is becoming an ever more acceptable answer to problems, even in the workplace. Very few people have had an opportunity to learn how to successfully navigate these stormy seas … until now.

This session draws on expertise from psychology, crisis management, mental health, law enforcement and more, providing a comprehensive approach to safety in interpersonal conflict. Although there is a strong emphasis on verbal skills, other factors include body language, proxemics and proper mindset. This approach empowers individuals to handle almost any professional and personal situations they may encounter in life. |

| |

|

| 9:15 a.m. |

Refreshment Break

|

| |

|

| 9:30 a.m. |

Breakout Sessions with Regulators

Kristi Nailor, Supervisory Examiner | Federal Reserve Bank of St. Louis

Paulette Thorne, Supervisory Examiner | FDIC

Allison Carpenter, National Bank Examiner | Office of the Comptroller of the Currency

Bankers can meet with their federal regulators to learn about exam hot topics and other regulatory issues. |

| |

|

| 10:30 a.m. |

Refreshment Break

|

| |

|

| 10:45 a.m. |

Compliance Officer in 2025 in Tumultuous Times

Patti Joyner, CRCM, Founder | Financial Solutions

Shaun Harms, CRCM Principal/Consulting, Regulatory Compliance | Forvis Mazars

This discussion with attendees will address some of the challenges facing compliance officers. With so much uncertainty looming, discussion will focus on best practices, resource challenges, regulator expectations, etc. |

| |

|

| 11:45 a.m. |

Adjourn

|